|

|

|

|

|

|

|

JOIN - Syndicate 1000 Group CASH System

JOIN - 4 Corners Alliance Group CASH System

JOIN - Godzone Credit Exchange CRYPTO_CREDIT System

JOIN - The Billion Coin CRYPTO-CURRENCY System

JOIN - Bitcoin - Open a Wallet CRYPTO-CURRENCY System

Global Advertising Internet Network Limited (hereby known as the "Company", "Umbrella Company", "Syndicator Company", "Management Company") and it's management team supports their subsidiary Syndicate 1000 Group and their vision to open positions for 1,000 Cooperative Syndicate's with 1,000 syndicate share portfolio's with 1,000 pledge member's for the benefit of all parties. The management team has an invested interest, earning a performance-based 10% management tithe on all sales revenue, assets, retirement capital and credit dividends. So it is in their best interest to perform well, and run a tight ship to reach the ultimate peak performance in reaching a capital value threshold of $5,000,000, so that the 10% management tithe increases to a 20% management tithe from thereafter. This increase is covered by the increased capital value of the Working Cooperative and effective management. The management team strives to be accountable and transparent in it's fiduciary responsibilities, yet, still remaining private and confidential in it's operations, protecting the privacy, trade secrets, copy-rights and intellectual property of the entire organization and it's structure.

The overall retirement term is 30 years with the first 5 Years start-up period for forming, storming, norming and performing so to speak. Structure adjustment and a settling period, to a right of renewal every 5 years thereafter. When the cooperative first launches there will be a period of the gathering (forming) of the 1,000 Pledge Member's. When you bring 1,000 pledge member's into a cooperative business model, there is always differences in opinions (storming) over business work ethics, structure, cultural values and practices and there is always jump the rabbit, whats in it for me and I can do better attitudes. The truth is on the contrary, otherwise they would be doing it. When the pledge member's who generally realize, working as ONE unified TEAM (norming) together everyone can achieve more and cooperation, adjustment, trust and commitment creates a very successful venture (performing).

We are now recruiting small to medium-sized start-up and established businesses and their Directors on our Business Round Table of 1,000 segment seats. There will be an Upper House Board of Directors and a Lower House Investment Management Team consisting of 24 Elders in each respective house. They will be upright, righteous and diligent with years of experience in the successful management of their own businesses that are part of this very co-op. Syndicate 1000 Group is the revised version of Cooperative Capital Aotearoa. Our vision is to establish 1,000 Head Cooperative Syndicates with 1,000 Syndicate Share's Portfolio's with 1,000 pledge member's in each, providing lump sum venture capital pledges of $1,000NZD and a debt servicing term pledge of $10NZD a week ongoing. Accurate record-keeping is paramount for the success of any Working Cooperative, especially one that will encompass 1,000 Cooperative Syndicate's consisting of 1,000 Syndicate Portfolio's with 1,000 Members in each syndicate. This will launch our Cooperative Group of Companies, each with $1,000,000NZD start-up capital and $520,000 annual debt servicing capital per syndicate portfolio within each Working Cooperative. We invite strong leader's in their respected communities to put their best foot forward and apply within.

Our affiliate referral program sets the stage for our members to find 4 or more business-minded people within the first month of joining Syndicate 1000 Group in the first portfolio we called Syndicate 01. Members are the back-bone of any syndicate, they are business-minded with ideas and innovative concepts for start-up models for businesses looking for capital or have an established business within the co-op and the most valued commodity to the Company and it's Cooperative Syndicate(s). Each member joins a working cooperative that encourages ongoing participation in sponsoring pledge member's and promoting it's products and services to communities locally, nationally and internationally to generate revenue for their own businesses and their co-op. There is a future career opportunity for both consumer's and start-up and established small to medium-sized commercial businesses, that from the outset, is generally never realized and often missed by our pledge member's.

When we reach our target of 1,000 pledge members we will establish a new cooperative entity with it's own business bank accounts and 1,000 signatories. One Account for the $10 a week debt servicing, One Account for the $1,000 capital investment and asset procurement with retirement capital, and one account for general business activities for everyone's sales on the open global marketplace and purchases for themselves and family, benefiting from both world's with share margins. Members who promote, list, sell, buy, barter, refer, trade and exchange products and services of the syndicate company and it's group of companies, cooperating and sharing in upfront performance-based commissions, incentives and profit margins, paid monthly with capital credits shared annually.

Syndicate 1000 Group Private Contract Association and its Cooperative Business Alliance merges its systems with numerous affiliated business societies to create abundance, wealth and prosperity for all, ending poverty and oppression forever. A step by step process that assists people to rise up from darkness into the light. A Brand NEW Concept to bring communities together creating asset procurement venture capital to develop food, clothes, housing, business, utilities, agriculture, aquaculture, forestry, and general natural, capital and human resources in Aotearoa (Aotearoha). You are applying to be a shareholder in a shares portfolio as a joint venture with 1,000 other pledge members. Independent Business Owners joining forces and cooperating in supply an demand of combined products and services that share 50/50 profit share margins. Your Business might take a cut in profits initially, but the volume of sales out way the losses.

A Working Cooperative that earns incentives and up-front performance-based revenue shares of profit margins from product and service sales and affiliate referral marketing.

This website has an annual membership pledge of 0.015 btc (BITCOIN) or $120 NZD plus GST. The company is offering a special offer until XMAS to reimburse the pledge if any member refers 10 or more people within their first month of joining and invoices the company. This basically can be considered a 10% performance-based incentive.

You MUST be a Pledge Member of both the Syndicate 1000 Group and our Affiliate Referral Program, 4 Corners Alliance Group. Together they form the strategy of the Cooperative Syndicate and the 4 Corners Alliance Group is the platform that tracks genealogy down-line throughout your network. To keep our Syndicate moving forward, we expect ALL members to have their 4 plus pledge members registered on the one-time $28 USD affiliate referral platform of 4 Corners Alliance Group and registered on the Syndicate 1000 Group website to login. All members MUST have their $10 NZD weekly term pledge active or they will be suspended from participation with any Syndicate until remedied.

It is inevitable that when everyone does their part and completes their workload task, the $1,000 NZD and more for other strategies will be covered by the return on investment with our affiliate referral platform of 4 Corners Alliance Group, making this one of the most affordable Working Cooperatives in the world.

With our business model we believe it has the potential to create Millionaires within Syndicate 1000 Group over a long term, hence why we make a commitment for up to 30 years plus, to ensure our member's benefits are experienced by family members from generation to generation.

Gavin intends to provide 7 Strategies with 7 multiple income streams to 7 Pacific Island Nations throughout the Pacific Triangle of TE-MOANA-NUI-A-KIWA, from Aotearoha the Kingdom Of Heaven, the county of Jew Zealand on the continent of Lemurya. Later to the 7 seas and 7 continents to 7 Sovereign Native Nations, maybe with 7 Spanish Angels, 7 truly a divine number of completion now moving to 8 the resurrection and new beginning of a new order or creation and the start of abundance, wealth and prosperity.

To get started..... 1,2,3 - Ready, Set, Go.....

First start your $10 NZD a week term pledge for 30 years with 5 year right of renewals. Complete your EXPRESSION OF INTEREST.

You will notice the affiliate marketing platform setup cost has increased to $28 USD One-Time Payment, not $18 USD. Transparency is important to us from the outset.

Join 4 Corners Alliance Group for a one-time $28 USD and set up 4 New Members within 2-4 weeks of joining into the program, which are the same 4 New members in Syndicate 1000 Group. We have a "Pay It Forward" strategy that costs $140 USD that covers the cost of you and your 4 pledge members to assist the process. (if you choose) By paying your pledge members setup cost in advance, encourages them to do the same and the process moves more swiftly. Being focused on business-minded people who is our target market.

Earn exponential rewards in 4 Corners Alliance Group that can be transferred from their US e-wallet account system to your NZ bank account and other crypto-currency accounts to cover your $1,000 NZD capital pledge. We are all about multiple income streams, so count the costs. More strategies to follow.

What will it cost for the initial set up?

The program Gavin has created can cover costs entirely and gives you a far greater return (anticipated over $500,000 return) and you can start in increment steps with as little as $10 NZD a week, but transparency shows currently you are probably looking at an up-front initial out of pocket expense outlay of $1,876 NZD or $40 NZD a week for One Year Only and an approximate $3,900 NZD or an ongoing commitment of $75 NZD a week until further notice up to a 30 year term that can be purchased outright for $117,000 for the entire 30-years (from your returns), from the starting date of the Syndicate to full-term maturity at 23 September 2048, less any contributions already made for an early settlement with 100% vote at each 5 year interval right of renewal. The only problem is the early settlement means less return as your returns are on capital growth over time on your venture capital. As a Working Cooperative we work together as a TEAM, encouraging one another so we all make it to the end results at the finish-line. Nobody will be left in darkness while walking among other lights. The company is determined to help all businesses achieve sales volume from the network of members and as the memberships flourish, we will provide new and exciting innovative and creative ways to succeed. A new change to the norm of what this current system has to offer. Below are 7 income streams Gavin Marsich is starting with Syndicate 1000 Group. He invites you to be part of his growing family. More strategies will follow....

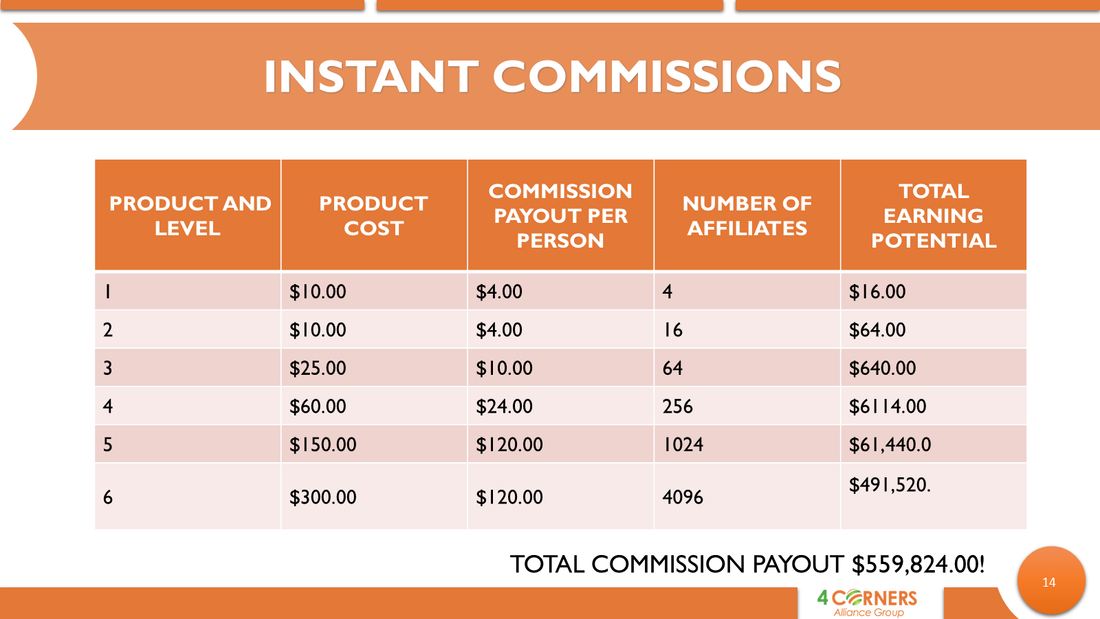

There will be an out of pocket expense of $28 USD ($45-$50 NZD) pledge (hypothecate) for the network platform with the Four Corners Alliance Group. This is where your 4 or more new members join your team within the first 2-4 weeks of you joining. This site can also provide a return of up to $559,824 USD to you directly that can alleviate any other costs below. It is through our Syndicate 1000 Group that our members have greater success, so we invoice a 10% management tithe for the use of our network of people and its strategic programs. This is how Syndicate 1000 Group subsidiary to Global Advertising Internet Network Limited provides a return to our members. (Conditions Apply)

Please take note that Global Advertising Internet Network Limited deals mostly in a virtual world of digital currencies like BITCOIN, (TBC) THE BILLION COIN and CREDIT on their very own credit exchange that is totally private and exclusive to members. A decentralized system that is not controlled by any government or the elite banking cartel.

There will be an out of pocket expense of 0.015 btc (Bitcoin) pledge or $120 NZD plus GST for the annual membership pledge to Global Advertising Internet Network Limited and the use of it's website, program, strategies and products and services in its e-commerce store. This can be reimbursed entirely if any member introduces 10 or more new memberships within the first month of joining in any given fiscal year, being based on 10 new members it is an incentive reward valued at 10% return.

There will be an out of pocket expense of 0.010 BTC (Bitcoin) pledge, worth currently as of 6th October 2018 of $110-$120 NZD to set up a Managed Funds Portfolio to also assist with covering costs. Gavin has strategies to increase the value of bitcoin, therefore creates a syndicate portfolio for a 50/50 Joint Venture. Member puts up the 0.010 BTC or $110-$120 NZD and Gavin Marsich works the account (as his share of the joint venture) with his skill in crypto-currency. This is a personal and private venture that Gavin does as a hobby and is transparent about this in the joint venture agreement.

It is through the Syndicate 1000 Group that our members have greater success, so Global Advertising Internet Network Limited, invoices a 10% management tithe for the use of our network of people and strategic programs. This is on all online money-making strategies.

(Conditions Apply)

There will be an out of pocket expense of $10 NZD for a weekly term pledge or $520 NZD annually until further notice (30-year term, 5-year right of renewal intervals) with a share of retirement capital that goes to a debt servicing account for asset procurement and community project investments we vote on. This includes revenue increasing portfolios to capitalize on the existing $10 NZD revenue streams coming in. Gavin is focused on money-management concepts and accountability to maximize returns for the Syndicate and its members. The higher the balance the more profit to share.

There will be a one-time out of pocket expense of $1,000 NZD for a capital pledge for a 30-year term, 5-year right of renewal intervals on an assets procurement and community project investments account with a share of retirement capital, a return for members or their children's, children for a thousand generations of bequeathing.

There will be an out of pocket expense (undisclosed) for sales of products and services purchased or sold within the Working Cooperative that you share 50/50 in the profit margins with your direct up-line, being your Syndicate on sales you personally introduced.

We are making the move into a virtual world of digital currency with Global Advertising Internet Network Limited and its economic trading and membership support network platform called Godzone Credit Exchange. There is a monthly 20 €Euro Dollars or 240 €Euro Dollars annual ($40 NZD approx or $480 NZD) platform service charge, being one-year in advance until further notice. Everyone receives a 10 Million Credit business start-up for inviting 10 or more New Memberships within the first month of joining. This provides the opportunity for virtually FREE trading locally, nationally and internationally. Credits are covered by a true intrinsic trading instrument value of a common law commercial lien over all the governments of the world. It is the NEW GLOBAL RESET everyone has been waiting for.

A late addition to the fold is "The Billion Coin" or TBC as many know it. An abundance coin with a maximum cap of One Billion Dollars per COIN. Value increases with membership at 1% - 5% Daily. There is a $10 USD ($20 NZD) one-time admin fee. We suggest to refer as many people as you can to receive 25,000 Kringle CASH that is exchanged into coin value. Gavin started in June 2017 and invested $150 USD ($250 NZD), signed up over 100 people and paid the admin fee. He is now working on signing up another 100 people, investing another $150 USD ($250 NZD) to increase his current value of over $120 Million in TBC Value to exchange with his very own CREDIT's on his global platform of digital currency. This is a new concept but you have to be in to win right. On 17 March 2010, the now-defunct BitcoinMarket.com exchange is the first one that starts operating. On 22 May 2010, Laszlo Hanyecz made the first real-world transaction by buying two pizzas in Jacksonville, Florida for 10,000 BTC. In five days, the price grew 900%, rising from $0.008 to $0.08 for 1 bitcoin. Look at the value now.

We are primarily a digital currency organization but we still allow room for the soon to become obsolete world of fiat currency that we all know holds only perceived value of the people and their belief system of product and service exchange.

As 50% of our funds will be debt-based we lock down the best strategies to secure competitive interest rates, maximize income, minimize expenses, minimize interest and save tens of thousands of dollars to maximize asset procurement and capital growth for our members to increase their share holdings over a 30 year term with right of renewals every 5 years.

To get access to the website, requires an expression of interest, a commitment to the term and capital pledge program and your commitment to sharing in the workload of inviting 4 or more people to this opportunity within the first 2-4 weeks of joining. Complete the Expression Of Interest form to get access to some of Gavin's strategies and start a payment program today.

Here is one of Gavin's strategies with our 4 Corners Alliance Group. A simple concept when you join Syndicate 1000 Group and setting up your $10 NZD weekly term and $1,000 NZD capital pledges to lock a position in a syndicate portfolio. Invite 4 or more people within the first 2-4 weeks of joining and they will do the same. Start purchasing or selling products and services from the website to earn profit margins. Everyone has to join 4 Corners Alliance Group for the affiliate marketing platform for Syndicate 1000 Group. It costs a one-time setup of $28 USD. Your earnings purchase digital products over 6-Levels and the profit is what gives you a financial return. Crowdfunding for business start-ups is legal in the United states.

The Jump-start Our Business Startups Act, or JOBS Act, is a law intended to encourage funding of small businesses in the United States by easing many of the country's securities regulations. It passed with bipartisan support, and was signed into law by President Barack Obama on April 5, 2012. Four Corners Alliance Group is a US Company, so as long as you pay your taxes on your funds received before you transfer into your New Zealand account, we are all covered.

This is simply a numbers game. If everyone completes their task of getting 4 or more people to invest $28 USD ($45-$50 NZD) for Four Corners Alliance Group, pay their up-front annual membership pledge of 0.015 btc (Bitcoin) or $120 NZD plus GST and add ($110 NZD) or 0.010 btc (Bitcoin) for their personally managed Bitcoin crypto-currency funds account to Global Advertising Internet Network Limited and start their $10 NZD weekly payment to Syndicate 1000 Group's, Syndicate 01 Account within 2-4 weeks of joining, you can see returns in your back-office USD e-wallet account immediately when people you invite joins and registers.

It is anticipated with our program that within the first 90-Days, you may have returns to cover your $1,000 NZD capital pledge, the up-front annual platform fee to the Godzone Credit Exchange and much, much more (Refer to the instant commissions chart above). Make more pledges to secure more positions within the syndicate portfolio and secure retirement capital for yours or your grandchildren's future and immediate returns on sales now. Go ahead, join 4 Corners Alliance and Syndicate 1000 Group's Today!

Manufacturer's and Supplier's share margin's 50/50 with Global Advertising Internet Network Limited (The Company). They share their margins 50/50 with Syndicate 1000 Group who share their margins 50/50 with the Cooperate Syndicate's. They then share their margins 50/50 with the Pledge Member's. Whoever makes a purchase for themselves or sells products and services to someone else, the entire up-line from that person, benefits from a share of the margins. Obviously the higher up the ladder you are the more commission you make on the sale. All of which is secured with monthly invoices before the Syndicator Company releases any commission payments. The before will apply to service businesses sharing their profit margins as well. Business sales volume that everyone from the community shares in, providing equality when listed through the company, everyone gets it for the same price and the willingness to help fellow members to succeed because we have an invested interest of 50/50 in their business. Surely a win, win for all.

Each syndicate will be made up of members that may or may not personally know each other, but have been collectively assembled together for a cooperative purpose. They meet to form the foundation of their co-op of 1,000 pledge member's to establish a Syndicate in partnership with the designer of the revised cooperative capital aotearoa concept, the Guardian Syndicator, Gavin Marsich of Global Advertising Internet Network Limited who is 100% Shareholder and Founder of the Syndicator Company.

When members join and make the pledge, they will have written contracts that outlines their duties, obligations and responsibilities to each syndicate they are member's too. Members shares are based on members ownership of pledges and their obligations and commitments to the cooperative. The pledge(s) give voting power at monthly events, the more you own the more votes you have in the decision making process of the syndicate, up to a maximum of 10 votes.

You get to vote on the top (5) five investment opportunities at these monthly events where the majority of votes win. Primarily it is your collective decision(s) on what your syndicate invests in and how it uses your share of the venture capital and how it impacts you and the community you live in, but typically provides a much better return on investment than that of a traditional bank investment or cash deposit account. The structure however will be 50% equity-based and 50% debt-based split into (3) three defined areas with 20% towards start-ups, 40% Real Estate and 40% established small to medium-sized businesses in your area. This is where communities bond together and become stronger, when neighbors have an invested interest and share in the opportunities in or around their communities.

The co-op is a 24/7 job, offering unlimited opportunities. You are even earning while you sleep as your products and services are displayed in advertising blocks 24-hours a day, 7-Days a week. It takes a huge lifestyle adjustment to the way most people traditionally do business or even the way most people can even comprehend. People are the greatest commodity of this realm. Without them it would be a desolate waste land. However, they have proven to be the most treacherous, destructive, war-mongering, segregated creatures on this planet, separated from reality and disillusioned by years of brain-washing and conditioning. Many feel alone, lost in a world of chaos and dismay, suppressed and oppressed by the greed of the elite puppet-masters. But we are on the mend, We are standing to attention. We are fighting back. I say, "RISE UP" from the ashes like a phoenix and we'll do it 1,000 times again. Take back what was always ours. Forgive, forget and move forward, one small step at a time. We will learn to trust again. We are survivors, being empowered by a few. I want to be empowered by you. Yes you the people. We 'the people'.... It's all about 'the people', "the people, the people, the people".

"He Tangata, He Tangata, He Tangata".

Global Advertising Internet Network Limited the Syndicator Company, shares margins with manufacturer and suppliers, less delivery costs and taxes of it's listed products and services on it's Company Websites, Social Media Pages and in Stores and Warehouses across the nation. As the Syndicate expands business activity increases with volume sales, allowing us buying power to bring prices down creating a price war that pushes for fair and equitable values. We envision our buying power will see us getting deals with local stores, community food markets, petrol stations, trade services, vehicle dealerships, real estate agencies and much more. Hence why Gavin Marsich will be researching technology to encompass our profit share (%) percentage margin formula's, to maximize our margins by running a tight ship.

If you are joining a syndicate and you are a start-up or established business that would like more sales volume and you can share your margins 50/50 and meet the expectations of the Syndicator Company, then joining the Cooperative Business Alliance is definitely the way to go. Gavin wants all the small to medium-sized businesses to unite and become syndicate co-op's. All it costs is $1,000NZD down and $10NZD a week ongoing to get started. Everyone helping each other to grow and rather than taking a big bite of the elephant and causing it to charge at you, we become the mouse that was asked, "How do you eat an elephant?", the reply was, "One little piece at a time". Taking smaller margins but getting volume business within a collective group of companies called a working co-op of pledge members uniting in global trade and sharing resources to reach the highest goals together. It's called "SMART" Business.

Although we are involved publicly with our communities, business remains in the private, in the clouds of online servers where online shopping is the "NEXT BIG THING" and many of our members are our suppliers of most of our products and services for commercial barter and trade. They are also our consumers that keep their business in-house, only shopping from within the co-op as true supporters of their own businesses where a profit share is made. Truly a working community bonding together and sharing in the spoils.

We do not believe this is a big ask as it is our membership network purchasing from within it's own business network establishing volume, creating buying power whether at the start of a syndicate or at the end of it. We also expect suppliers to be drop-shipping their products direct to our customers door via track and trace courier delivery services. By forging strong relationships between the syndicator company and merchant, the merchant could supply merchandise FREE to our warehouses under an insurance policy for faster service and delivery times, retaining our customers. If a customer is happy they will be repeat shopper's. We try to be competitive, listing the same price as other retailers, but on many occasion we are higher because of GST and delivery charges. This is inevitable with online purchasing and the nature of the beast so to speak.

However, if people take into account, driving to the mall, the time to shop, purchasing items they really didn't want because it was eye candy, lugging the family around and possibly going to the food mall because everyone is tired and hungry, the stress and the costs, our products purchased for a few extra dollars more, online with us, works out to be much more affordable. As a member it is also much better to purchase from yourself and your own Cooperative Syndicate as you are a member that shares in it's profit margins, which really is a discount in anyone's book.

STOP purchasing someone else's products and services, giving away your money to outside competitors that could have helped you, other pledge members, your own co-op, the syndicator company and the manufacturer/supplier within the co-op network you belong too.

As a working cooperative, members increase the revenue of their syndicate(s) by the business activity they are actively involved in, providing a share of the commission to their syndicate and upfront commissions for themselves which can cover any initial outlay. The more you do, the more you get out of it but in doing so the syndicate get's a (%) percentage share of each sale of the products and services you actively promote, list, sell, buy, barter, refer, trade and exchange that you are a beneficiary of when assets accumulate and increase in value. At some time in the future (if and when that happens) the shareholders decide on winding the syndicate down, the assets are sold, shares are disbursed and the syndicate is closed for business entirely. It will be the board of directors, made up of directors from the co-op companies within our network that will decide on the shares disbursement each member get's, as it will be based on productivity and effort each member proactively participated in. If you are a businesses that requires more sales, then a cooperative is the answer and for an individual, the opportunities of employment and contracting will be endless.

Each syndicate will have access to the Syndicator Company and it's Group of Companies products and services within the co-op network during the contractual term of engagement. These contracts can be terminated if there are any breaches. If the before occurs, the Syndicator Company will step into the terminated position and resume the responsibility of it's membership.

Each syndicate will be managed by the Guardian Syndicator under the Syndicator Company for the duration of the syndicate(s) life, even when it forms it's own entity. The Guardian Syndicator or Syndicator Company can never be over-thrown or voted out of office. The Guardian Syndicator of the Syndicator Company is 100% Shareholder and founding initiator of Global Advertising Internet Network Limited and each syndicate will be a subsidiary group in a group of cooperative's that the Guardian Syndicator and Syndicator Company will be a shareholder. This by no means, give's any pledge member the idea that they are shareholders of the Syndicator Company, Global Advertising Internet Network Limited as Gavin Marsich is the 100% shareholder of the Syndicator Company with a private discretionary trust will and testament that has succession trustees and beneficiaries. The Syndicate has only been initiated by the Syndicator Gavin Marsich under the umbrella of an advertising, sales and marketing company that was established 26th January 2012. Other subsidiary business concepts that are owned my Gavin Marsich are also part of the cooperative and form the foundation blocks of Global Advertising Internet Network Limited. The syndicates bank account initially is a subsidiary bank account of the company and the concept is owned by the Syndicator Gavin Marsich.

The syndicate is not designed for profit necessarily, but for creating better employment opportunities, trade & commerce, cooperative industry, improving environment, agriculture, fisheries, natural energy, education, transportation, waste management, housing homeless, produce markets, developing community projects and generally bringing people together more under a divine governance, out of the private into the public working in cooperative communities around Aotearoa and eventually around the world to end poverty and oppression forever.

If after a minimum of (5) five years the members quorum of 80% votes to wind the Working Cooperative Syndicate down, then all assets will be sold and each pledge member will receive their share of the remaining equitable value after costs as a shareholders dividend. Then the cooperative syndicate share's portfolio will resume under new syndicate pledge member's. Each share will be offered for sale to other syndicate's to take over your share's or offered to the open market for public offering. This process may take some time as it is always a drawn-out lengthy process.

It is the interest of the Guardian Syndicator and the Syndicator Company to reach a goal of 144 Syndicates with 1,000 pledges each, a divine number we would like to reach, consisting of business owners, each with a pledge, a profile and a business of their own that intends to establish their own syndicate 1000 groups to set the world stage for a GLOBAL RESET of the 144,000 Saints.

Cooperative Capital Aotearoa set the bench mark for the concept of Syndicate 1,000 Group. It lets a community of people pledge small amounts of money, vote on how they want to use it to generate returns with a focus on improving their neighborhood, community or city.

The only commitment to secure your portfolio segment(s) initially is the weekly $10 contribution pledge to start from the launch date and first depositor of any new syndicate portfolio, who is normally the Syndicator Gavin Marsich. Each syndicate portfolio consists of 1,000 pledges of members of each syndicate. When each syndicate portfolio reaches it's desired target, a New Syndicate Portfolio is established. If however, Gavin Marsich can find suitable candidates to establish syndicate portfolio's with 1,000 pledge member's in each, the cooperative industry will develop much sooner, catering for the growing interest in the Working Cooperative model. These manager's will manage their respective syndicate portfolio's and share 50/50 of the 10% management tithe and the increase to 20% when the threshold of $5,000,000 is reached that the Company receives. Everyone is a winner and nobody is left behind when each member of the cooperative receives a share of the margins. No matter what date you start to the build-up to the 1,000 pledges, your $10NZD contribution pledge will always be back-dated to the launch date of any New Syndicate, so that it keeps everyone on an equal footing and each individual member has equal opportunity to excel in a working cooperative. The $1,000NZD Capital Pledge will be required when we reach 1,000 pledges or before, secured at a meeting of people who have made their $10NZD a week contribution term pledge and locked in 4 friends per segment they own. We are clear about our motives to establish a joint venture. Therefore we expect the pledge member's commitment from the outset with an up-front $1,000NZD immediately or as soon as possible before they have any say.

PLEASE NOTE:

It is clear we have altered the original concept slightly to encompass 1,000 pledge member's contributing a 1% or $10NZD weekly ongoing contribution pledge on each portfolio segment block to create an income base for each shares portfolio syndicate trust for future debt servicing account for borrowed equitable funds and an upfront $1,000NZD Capital Pledge to procure assets and profitable investments for a retirement fund and added the affiliate referral program of securing 4 or more pledge member's within the first month of joining to share the workload equally among the member's so there is no animosity later.

An investment committee will review and rate all opportunities, and the larger group of investors will vote on the top (5) five. The winning choices will go into a due diligence stage, in which Company Syndicator will determine if the investment can produce at least a 6% annual rate of return.

Gavin Marsich is also seeking to establish a syndicate for overseas migrants to establish a portfolio with much higher term and capital pledge stakes, being an amount of $10,000 ongoing weekly term pledge and a lump-sum amount of $1,000,000 as the capital pledge. The stakeholders can include current cooperatives anywhere in the world that would like to establish a market in Aotearoa (New Zealand) but under the Syndicator Company's management and control and not monopolized by any one cooperative but a collective group of cooperatives. This will have a Syndicate with venture capital of 1 Billion Dollars with 520 Million in annual term pledges plus any member(s) activity and commission shares. Interested parties need to immediately express their interest in private to Gavin Marsich and the Syndicator Company. This opportunity can also extend to any syndicate here in Aotearoa (New Zealand) with their current model that allows them to front up with their $1 Million Dollar capital pledge and their $520,000 annual term pledge with their business activity supporting their current syndicate for return on investment.

The Member/Shareholder owns a share(s) of each portfolio and its assets which includes its debt servicing account that is used for asset procurement. The working co-op and it's business activity from shared margins will create an operations account and any annual profit after expenses will provide a dividend share for each portfolio segment the Member/Shareholder owns. Membership to the Co-op is voluntary and if and when a member wishes to resign or be removed from the syndicate and its commitments, their share(s) will be offered first to the Syndicator, Gavin Marsich, then to the Syndicate of shareholders if the Syndicator declines to purchase.

Although the fund will focus initially on syndication in real estate to buy, renovate, sell or lease to own under property management, the same model can be used to invest in local established businesses and new viable start-up concepts that show good future returns. A new coffee shop or restaurant that might struggle to get capital from a bank could potentially get an investment from the fund–which would then share revenue with investors as the business grows.

“That’s where we could really use the power of that large base of people investing and then having an incentive to actually frequent those places to reap a benefit and return on investment,” says Gavin Marsich. When people individually benefit, so will the community; local businesses create jobs and recirculate money within a city, and refurbished homes help increase property values for neighbors.

The fund will allow a group to collectively use the aggregated capital in the way they think is best–and will help focus that larger group on solutions. All members would be required to refer 4 or more people to help grow the collective membership to increase capital for asset procurement that provides good returns and future job opportunities within a cooperative business alliance where our members benefit.

The term of each Syndicate Portfolio is 30 years with 5 year increments of right of renewal of a further 5 years and so on. (Indefinite by choice). All members get a vote, based on the amount of pledges they own. One pledge, one vote up to 10 votes. An 80%+ quorum vote will be required for any winding up of any syndicate portfolio before term maturity. All other general meeting votes will be majority rule and when 50/50 the deciding vote will be the Syndicators. Each member that does not vote, that vote will be allocated to the Syndicator to use or not use in a decision making process. So we encourage you to vote, whether by deed poll sent in an email or Facebook page or at an actual monthly meeting. Four (4) meetings, 5 Hour sessions will most likely be split over a 2-Day weekend from 8:00am to 1:00pm and 3:00pm to 8:00pm and will be hosted by Coffee Outbreak Network Group at their venues throughout Aotearoa with (250) limited number of seats at a pre-booked cost of $200NZD a seat for business networking, presentations, financial updates, co-op news, one (1) minute introductions for new and existing business members, product and service sales promotions during which referral names are passed around and business card box is topped up, a paid $100NZD pre-booked slot time for (20) minutes for any business that would like a personalized promotional presentation on their own specific business, breakfast/lunch/dinner to list, sell, refer, promote barter, trade and exchange. The meetings will be videoed and MP3/MP4 and Youtube Video files will be available for sale at event venues and online. Seats for up-coming events are pre-booked and paid for before the next session. Each session has limited seats depending on size of venue, so there will be session times available throughout the event day. Laptop Computer use will be available in our internet café setting. The investment and management committee provides up to 5 investment options to vote on in monthly breakfast meetings where business will be conducted with Coffee Outbreak Network Group.

In summary, The $10 NZD supports any debt servicing, the $1,000 NZD supports capital assets for retirement capital, the product and service sales, supports member’s and the co-op and the business meeting support business trade activity. Share dividends of Capital Credits from the business operations account (if any) will be available after each audit of the previous fiscal year and disbursed at the appropriate time. These shares will be proportioned on performance-based income contributed by each member individually during the fiscal year. Within the working cooperative. The more sales, the more upfront monthly share margins for everyone and the more individual dividends each year. The debt servicing account and asset procurement holdings account has a 30 year term for retirement capital and will be disbursed after auditing and calculations in equal shares at the appropriate time.

Do you need a job?

Consider the possibilities with the Cooperative. As shareholders you will have each opportunity pass by you at each meeting you attend. These meetings are breakfast business network gatherings with Coffee Outbreak Network Group. If an opportunity arises for a Working Cooperative, we are certain to look for the experience within, rather than go to external human resource agencies.

Do you have an established business model or have a promising start-up concept in the pipeline?

Like above, we certainly keep things in-house. Working together everyone achieves more. Simply talk to the Syndicator Gavin Marsich, our Business Consultant to plan forward how best your business can benefit you and the Cooperative. Those who fail to plan, plan to fail. Get your business ideas and business plan on the table for complete transparency and due diligence and then take action, implementing your plan step by step.

The Syndicator Gavin Marsich, guardian of Global Advertising Internet Network LTD, acting as an umbrella company for Cooperative Capital Aotearoa and it's concepts, cooperative business alliances, segmented portfolio syndicates, strategies etc; will charge an upfront consultation fee for his advice but it is well worth the time and money that starts at $500.

Global Advertising Internet Network Limited (GAIN) and (CCA) the revised version of Syndicate 1000 Group is a socially responsible pledge fund that invests in cooperative businesses in the form of "patient capital,” or equity-like financing. GAIN assists the New Zealand cooperative industry to grow and flourish by providing capital that acts like equity without requiring coops to give up control over their own management and destiny, as traditional venture capital might.

MISSION

GAIN supports new and existing, cooperative and democratically owned and controlled enterprises, with preference to those that serve low-income communities. GAIN shall accomplish its mission through:

It is the intent of GAIN to build a more just economic system by:

GOALS

The central goals of GAIN's initial fund are as follows:

JOIN - 4 Corners Alliance Group CASH System

JOIN - Godzone Credit Exchange CRYPTO_CREDIT System

JOIN - The Billion Coin CRYPTO-CURRENCY System

JOIN - Bitcoin - Open a Wallet CRYPTO-CURRENCY System

Global Advertising Internet Network Limited (hereby known as the "Company", "Umbrella Company", "Syndicator Company", "Management Company") and it's management team supports their subsidiary Syndicate 1000 Group and their vision to open positions for 1,000 Cooperative Syndicate's with 1,000 syndicate share portfolio's with 1,000 pledge member's for the benefit of all parties. The management team has an invested interest, earning a performance-based 10% management tithe on all sales revenue, assets, retirement capital and credit dividends. So it is in their best interest to perform well, and run a tight ship to reach the ultimate peak performance in reaching a capital value threshold of $5,000,000, so that the 10% management tithe increases to a 20% management tithe from thereafter. This increase is covered by the increased capital value of the Working Cooperative and effective management. The management team strives to be accountable and transparent in it's fiduciary responsibilities, yet, still remaining private and confidential in it's operations, protecting the privacy, trade secrets, copy-rights and intellectual property of the entire organization and it's structure.

The overall retirement term is 30 years with the first 5 Years start-up period for forming, storming, norming and performing so to speak. Structure adjustment and a settling period, to a right of renewal every 5 years thereafter. When the cooperative first launches there will be a period of the gathering (forming) of the 1,000 Pledge Member's. When you bring 1,000 pledge member's into a cooperative business model, there is always differences in opinions (storming) over business work ethics, structure, cultural values and practices and there is always jump the rabbit, whats in it for me and I can do better attitudes. The truth is on the contrary, otherwise they would be doing it. When the pledge member's who generally realize, working as ONE unified TEAM (norming) together everyone can achieve more and cooperation, adjustment, trust and commitment creates a very successful venture (performing).

We are now recruiting small to medium-sized start-up and established businesses and their Directors on our Business Round Table of 1,000 segment seats. There will be an Upper House Board of Directors and a Lower House Investment Management Team consisting of 24 Elders in each respective house. They will be upright, righteous and diligent with years of experience in the successful management of their own businesses that are part of this very co-op. Syndicate 1000 Group is the revised version of Cooperative Capital Aotearoa. Our vision is to establish 1,000 Head Cooperative Syndicates with 1,000 Syndicate Share's Portfolio's with 1,000 pledge member's in each, providing lump sum venture capital pledges of $1,000NZD and a debt servicing term pledge of $10NZD a week ongoing. Accurate record-keeping is paramount for the success of any Working Cooperative, especially one that will encompass 1,000 Cooperative Syndicate's consisting of 1,000 Syndicate Portfolio's with 1,000 Members in each syndicate. This will launch our Cooperative Group of Companies, each with $1,000,000NZD start-up capital and $520,000 annual debt servicing capital per syndicate portfolio within each Working Cooperative. We invite strong leader's in their respected communities to put their best foot forward and apply within.

Our affiliate referral program sets the stage for our members to find 4 or more business-minded people within the first month of joining Syndicate 1000 Group in the first portfolio we called Syndicate 01. Members are the back-bone of any syndicate, they are business-minded with ideas and innovative concepts for start-up models for businesses looking for capital or have an established business within the co-op and the most valued commodity to the Company and it's Cooperative Syndicate(s). Each member joins a working cooperative that encourages ongoing participation in sponsoring pledge member's and promoting it's products and services to communities locally, nationally and internationally to generate revenue for their own businesses and their co-op. There is a future career opportunity for both consumer's and start-up and established small to medium-sized commercial businesses, that from the outset, is generally never realized and often missed by our pledge member's.

When we reach our target of 1,000 pledge members we will establish a new cooperative entity with it's own business bank accounts and 1,000 signatories. One Account for the $10 a week debt servicing, One Account for the $1,000 capital investment and asset procurement with retirement capital, and one account for general business activities for everyone's sales on the open global marketplace and purchases for themselves and family, benefiting from both world's with share margins. Members who promote, list, sell, buy, barter, refer, trade and exchange products and services of the syndicate company and it's group of companies, cooperating and sharing in upfront performance-based commissions, incentives and profit margins, paid monthly with capital credits shared annually.

Syndicate 1000 Group Private Contract Association and its Cooperative Business Alliance merges its systems with numerous affiliated business societies to create abundance, wealth and prosperity for all, ending poverty and oppression forever. A step by step process that assists people to rise up from darkness into the light. A Brand NEW Concept to bring communities together creating asset procurement venture capital to develop food, clothes, housing, business, utilities, agriculture, aquaculture, forestry, and general natural, capital and human resources in Aotearoa (Aotearoha). You are applying to be a shareholder in a shares portfolio as a joint venture with 1,000 other pledge members. Independent Business Owners joining forces and cooperating in supply an demand of combined products and services that share 50/50 profit share margins. Your Business might take a cut in profits initially, but the volume of sales out way the losses.

A Working Cooperative that earns incentives and up-front performance-based revenue shares of profit margins from product and service sales and affiliate referral marketing.

This website has an annual membership pledge of 0.015 btc (BITCOIN) or $120 NZD plus GST. The company is offering a special offer until XMAS to reimburse the pledge if any member refers 10 or more people within their first month of joining and invoices the company. This basically can be considered a 10% performance-based incentive.

You MUST be a Pledge Member of both the Syndicate 1000 Group and our Affiliate Referral Program, 4 Corners Alliance Group. Together they form the strategy of the Cooperative Syndicate and the 4 Corners Alliance Group is the platform that tracks genealogy down-line throughout your network. To keep our Syndicate moving forward, we expect ALL members to have their 4 plus pledge members registered on the one-time $28 USD affiliate referral platform of 4 Corners Alliance Group and registered on the Syndicate 1000 Group website to login. All members MUST have their $10 NZD weekly term pledge active or they will be suspended from participation with any Syndicate until remedied.

It is inevitable that when everyone does their part and completes their workload task, the $1,000 NZD and more for other strategies will be covered by the return on investment with our affiliate referral platform of 4 Corners Alliance Group, making this one of the most affordable Working Cooperatives in the world.

With our business model we believe it has the potential to create Millionaires within Syndicate 1000 Group over a long term, hence why we make a commitment for up to 30 years plus, to ensure our member's benefits are experienced by family members from generation to generation.

Gavin intends to provide 7 Strategies with 7 multiple income streams to 7 Pacific Island Nations throughout the Pacific Triangle of TE-MOANA-NUI-A-KIWA, from Aotearoha the Kingdom Of Heaven, the county of Jew Zealand on the continent of Lemurya. Later to the 7 seas and 7 continents to 7 Sovereign Native Nations, maybe with 7 Spanish Angels, 7 truly a divine number of completion now moving to 8 the resurrection and new beginning of a new order or creation and the start of abundance, wealth and prosperity.

To get started..... 1,2,3 - Ready, Set, Go.....

First start your $10 NZD a week term pledge for 30 years with 5 year right of renewals. Complete your EXPRESSION OF INTEREST.

You will notice the affiliate marketing platform setup cost has increased to $28 USD One-Time Payment, not $18 USD. Transparency is important to us from the outset.

Join 4 Corners Alliance Group for a one-time $28 USD and set up 4 New Members within 2-4 weeks of joining into the program, which are the same 4 New members in Syndicate 1000 Group. We have a "Pay It Forward" strategy that costs $140 USD that covers the cost of you and your 4 pledge members to assist the process. (if you choose) By paying your pledge members setup cost in advance, encourages them to do the same and the process moves more swiftly. Being focused on business-minded people who is our target market.

Earn exponential rewards in 4 Corners Alliance Group that can be transferred from their US e-wallet account system to your NZ bank account and other crypto-currency accounts to cover your $1,000 NZD capital pledge. We are all about multiple income streams, so count the costs. More strategies to follow.

What will it cost for the initial set up?

The program Gavin has created can cover costs entirely and gives you a far greater return (anticipated over $500,000 return) and you can start in increment steps with as little as $10 NZD a week, but transparency shows currently you are probably looking at an up-front initial out of pocket expense outlay of $1,876 NZD or $40 NZD a week for One Year Only and an approximate $3,900 NZD or an ongoing commitment of $75 NZD a week until further notice up to a 30 year term that can be purchased outright for $117,000 for the entire 30-years (from your returns), from the starting date of the Syndicate to full-term maturity at 23 September 2048, less any contributions already made for an early settlement with 100% vote at each 5 year interval right of renewal. The only problem is the early settlement means less return as your returns are on capital growth over time on your venture capital. As a Working Cooperative we work together as a TEAM, encouraging one another so we all make it to the end results at the finish-line. Nobody will be left in darkness while walking among other lights. The company is determined to help all businesses achieve sales volume from the network of members and as the memberships flourish, we will provide new and exciting innovative and creative ways to succeed. A new change to the norm of what this current system has to offer. Below are 7 income streams Gavin Marsich is starting with Syndicate 1000 Group. He invites you to be part of his growing family. More strategies will follow....

There will be an out of pocket expense of $28 USD ($45-$50 NZD) pledge (hypothecate) for the network platform with the Four Corners Alliance Group. This is where your 4 or more new members join your team within the first 2-4 weeks of you joining. This site can also provide a return of up to $559,824 USD to you directly that can alleviate any other costs below. It is through our Syndicate 1000 Group that our members have greater success, so we invoice a 10% management tithe for the use of our network of people and its strategic programs. This is how Syndicate 1000 Group subsidiary to Global Advertising Internet Network Limited provides a return to our members. (Conditions Apply)

Please take note that Global Advertising Internet Network Limited deals mostly in a virtual world of digital currencies like BITCOIN, (TBC) THE BILLION COIN and CREDIT on their very own credit exchange that is totally private and exclusive to members. A decentralized system that is not controlled by any government or the elite banking cartel.

There will be an out of pocket expense of 0.015 btc (Bitcoin) pledge or $120 NZD plus GST for the annual membership pledge to Global Advertising Internet Network Limited and the use of it's website, program, strategies and products and services in its e-commerce store. This can be reimbursed entirely if any member introduces 10 or more new memberships within the first month of joining in any given fiscal year, being based on 10 new members it is an incentive reward valued at 10% return.

There will be an out of pocket expense of 0.010 BTC (Bitcoin) pledge, worth currently as of 6th October 2018 of $110-$120 NZD to set up a Managed Funds Portfolio to also assist with covering costs. Gavin has strategies to increase the value of bitcoin, therefore creates a syndicate portfolio for a 50/50 Joint Venture. Member puts up the 0.010 BTC or $110-$120 NZD and Gavin Marsich works the account (as his share of the joint venture) with his skill in crypto-currency. This is a personal and private venture that Gavin does as a hobby and is transparent about this in the joint venture agreement.

It is through the Syndicate 1000 Group that our members have greater success, so Global Advertising Internet Network Limited, invoices a 10% management tithe for the use of our network of people and strategic programs. This is on all online money-making strategies.

(Conditions Apply)

There will be an out of pocket expense of $10 NZD for a weekly term pledge or $520 NZD annually until further notice (30-year term, 5-year right of renewal intervals) with a share of retirement capital that goes to a debt servicing account for asset procurement and community project investments we vote on. This includes revenue increasing portfolios to capitalize on the existing $10 NZD revenue streams coming in. Gavin is focused on money-management concepts and accountability to maximize returns for the Syndicate and its members. The higher the balance the more profit to share.

There will be a one-time out of pocket expense of $1,000 NZD for a capital pledge for a 30-year term, 5-year right of renewal intervals on an assets procurement and community project investments account with a share of retirement capital, a return for members or their children's, children for a thousand generations of bequeathing.

There will be an out of pocket expense (undisclosed) for sales of products and services purchased or sold within the Working Cooperative that you share 50/50 in the profit margins with your direct up-line, being your Syndicate on sales you personally introduced.

We are making the move into a virtual world of digital currency with Global Advertising Internet Network Limited and its economic trading and membership support network platform called Godzone Credit Exchange. There is a monthly 20 €Euro Dollars or 240 €Euro Dollars annual ($40 NZD approx or $480 NZD) platform service charge, being one-year in advance until further notice. Everyone receives a 10 Million Credit business start-up for inviting 10 or more New Memberships within the first month of joining. This provides the opportunity for virtually FREE trading locally, nationally and internationally. Credits are covered by a true intrinsic trading instrument value of a common law commercial lien over all the governments of the world. It is the NEW GLOBAL RESET everyone has been waiting for.

A late addition to the fold is "The Billion Coin" or TBC as many know it. An abundance coin with a maximum cap of One Billion Dollars per COIN. Value increases with membership at 1% - 5% Daily. There is a $10 USD ($20 NZD) one-time admin fee. We suggest to refer as many people as you can to receive 25,000 Kringle CASH that is exchanged into coin value. Gavin started in June 2017 and invested $150 USD ($250 NZD), signed up over 100 people and paid the admin fee. He is now working on signing up another 100 people, investing another $150 USD ($250 NZD) to increase his current value of over $120 Million in TBC Value to exchange with his very own CREDIT's on his global platform of digital currency. This is a new concept but you have to be in to win right. On 17 March 2010, the now-defunct BitcoinMarket.com exchange is the first one that starts operating. On 22 May 2010, Laszlo Hanyecz made the first real-world transaction by buying two pizzas in Jacksonville, Florida for 10,000 BTC. In five days, the price grew 900%, rising from $0.008 to $0.08 for 1 bitcoin. Look at the value now.

We are primarily a digital currency organization but we still allow room for the soon to become obsolete world of fiat currency that we all know holds only perceived value of the people and their belief system of product and service exchange.

As 50% of our funds will be debt-based we lock down the best strategies to secure competitive interest rates, maximize income, minimize expenses, minimize interest and save tens of thousands of dollars to maximize asset procurement and capital growth for our members to increase their share holdings over a 30 year term with right of renewals every 5 years.

To get access to the website, requires an expression of interest, a commitment to the term and capital pledge program and your commitment to sharing in the workload of inviting 4 or more people to this opportunity within the first 2-4 weeks of joining. Complete the Expression Of Interest form to get access to some of Gavin's strategies and start a payment program today.

Here is one of Gavin's strategies with our 4 Corners Alliance Group. A simple concept when you join Syndicate 1000 Group and setting up your $10 NZD weekly term and $1,000 NZD capital pledges to lock a position in a syndicate portfolio. Invite 4 or more people within the first 2-4 weeks of joining and they will do the same. Start purchasing or selling products and services from the website to earn profit margins. Everyone has to join 4 Corners Alliance Group for the affiliate marketing platform for Syndicate 1000 Group. It costs a one-time setup of $28 USD. Your earnings purchase digital products over 6-Levels and the profit is what gives you a financial return. Crowdfunding for business start-ups is legal in the United states.

The Jump-start Our Business Startups Act, or JOBS Act, is a law intended to encourage funding of small businesses in the United States by easing many of the country's securities regulations. It passed with bipartisan support, and was signed into law by President Barack Obama on April 5, 2012. Four Corners Alliance Group is a US Company, so as long as you pay your taxes on your funds received before you transfer into your New Zealand account, we are all covered.

This is simply a numbers game. If everyone completes their task of getting 4 or more people to invest $28 USD ($45-$50 NZD) for Four Corners Alliance Group, pay their up-front annual membership pledge of 0.015 btc (Bitcoin) or $120 NZD plus GST and add ($110 NZD) or 0.010 btc (Bitcoin) for their personally managed Bitcoin crypto-currency funds account to Global Advertising Internet Network Limited and start their $10 NZD weekly payment to Syndicate 1000 Group's, Syndicate 01 Account within 2-4 weeks of joining, you can see returns in your back-office USD e-wallet account immediately when people you invite joins and registers.

It is anticipated with our program that within the first 90-Days, you may have returns to cover your $1,000 NZD capital pledge, the up-front annual platform fee to the Godzone Credit Exchange and much, much more (Refer to the instant commissions chart above). Make more pledges to secure more positions within the syndicate portfolio and secure retirement capital for yours or your grandchildren's future and immediate returns on sales now. Go ahead, join 4 Corners Alliance and Syndicate 1000 Group's Today!

Manufacturer's and Supplier's share margin's 50/50 with Global Advertising Internet Network Limited (The Company). They share their margins 50/50 with Syndicate 1000 Group who share their margins 50/50 with the Cooperate Syndicate's. They then share their margins 50/50 with the Pledge Member's. Whoever makes a purchase for themselves or sells products and services to someone else, the entire up-line from that person, benefits from a share of the margins. Obviously the higher up the ladder you are the more commission you make on the sale. All of which is secured with monthly invoices before the Syndicator Company releases any commission payments. The before will apply to service businesses sharing their profit margins as well. Business sales volume that everyone from the community shares in, providing equality when listed through the company, everyone gets it for the same price and the willingness to help fellow members to succeed because we have an invested interest of 50/50 in their business. Surely a win, win for all.

Each syndicate will be made up of members that may or may not personally know each other, but have been collectively assembled together for a cooperative purpose. They meet to form the foundation of their co-op of 1,000 pledge member's to establish a Syndicate in partnership with the designer of the revised cooperative capital aotearoa concept, the Guardian Syndicator, Gavin Marsich of Global Advertising Internet Network Limited who is 100% Shareholder and Founder of the Syndicator Company.

When members join and make the pledge, they will have written contracts that outlines their duties, obligations and responsibilities to each syndicate they are member's too. Members shares are based on members ownership of pledges and their obligations and commitments to the cooperative. The pledge(s) give voting power at monthly events, the more you own the more votes you have in the decision making process of the syndicate, up to a maximum of 10 votes.

You get to vote on the top (5) five investment opportunities at these monthly events where the majority of votes win. Primarily it is your collective decision(s) on what your syndicate invests in and how it uses your share of the venture capital and how it impacts you and the community you live in, but typically provides a much better return on investment than that of a traditional bank investment or cash deposit account. The structure however will be 50% equity-based and 50% debt-based split into (3) three defined areas with 20% towards start-ups, 40% Real Estate and 40% established small to medium-sized businesses in your area. This is where communities bond together and become stronger, when neighbors have an invested interest and share in the opportunities in or around their communities.

The co-op is a 24/7 job, offering unlimited opportunities. You are even earning while you sleep as your products and services are displayed in advertising blocks 24-hours a day, 7-Days a week. It takes a huge lifestyle adjustment to the way most people traditionally do business or even the way most people can even comprehend. People are the greatest commodity of this realm. Without them it would be a desolate waste land. However, they have proven to be the most treacherous, destructive, war-mongering, segregated creatures on this planet, separated from reality and disillusioned by years of brain-washing and conditioning. Many feel alone, lost in a world of chaos and dismay, suppressed and oppressed by the greed of the elite puppet-masters. But we are on the mend, We are standing to attention. We are fighting back. I say, "RISE UP" from the ashes like a phoenix and we'll do it 1,000 times again. Take back what was always ours. Forgive, forget and move forward, one small step at a time. We will learn to trust again. We are survivors, being empowered by a few. I want to be empowered by you. Yes you the people. We 'the people'.... It's all about 'the people', "the people, the people, the people".

"He Tangata, He Tangata, He Tangata".

Global Advertising Internet Network Limited the Syndicator Company, shares margins with manufacturer and suppliers, less delivery costs and taxes of it's listed products and services on it's Company Websites, Social Media Pages and in Stores and Warehouses across the nation. As the Syndicate expands business activity increases with volume sales, allowing us buying power to bring prices down creating a price war that pushes for fair and equitable values. We envision our buying power will see us getting deals with local stores, community food markets, petrol stations, trade services, vehicle dealerships, real estate agencies and much more. Hence why Gavin Marsich will be researching technology to encompass our profit share (%) percentage margin formula's, to maximize our margins by running a tight ship.

If you are joining a syndicate and you are a start-up or established business that would like more sales volume and you can share your margins 50/50 and meet the expectations of the Syndicator Company, then joining the Cooperative Business Alliance is definitely the way to go. Gavin wants all the small to medium-sized businesses to unite and become syndicate co-op's. All it costs is $1,000NZD down and $10NZD a week ongoing to get started. Everyone helping each other to grow and rather than taking a big bite of the elephant and causing it to charge at you, we become the mouse that was asked, "How do you eat an elephant?", the reply was, "One little piece at a time". Taking smaller margins but getting volume business within a collective group of companies called a working co-op of pledge members uniting in global trade and sharing resources to reach the highest goals together. It's called "SMART" Business.

Although we are involved publicly with our communities, business remains in the private, in the clouds of online servers where online shopping is the "NEXT BIG THING" and many of our members are our suppliers of most of our products and services for commercial barter and trade. They are also our consumers that keep their business in-house, only shopping from within the co-op as true supporters of their own businesses where a profit share is made. Truly a working community bonding together and sharing in the spoils.

We do not believe this is a big ask as it is our membership network purchasing from within it's own business network establishing volume, creating buying power whether at the start of a syndicate or at the end of it. We also expect suppliers to be drop-shipping their products direct to our customers door via track and trace courier delivery services. By forging strong relationships between the syndicator company and merchant, the merchant could supply merchandise FREE to our warehouses under an insurance policy for faster service and delivery times, retaining our customers. If a customer is happy they will be repeat shopper's. We try to be competitive, listing the same price as other retailers, but on many occasion we are higher because of GST and delivery charges. This is inevitable with online purchasing and the nature of the beast so to speak.

However, if people take into account, driving to the mall, the time to shop, purchasing items they really didn't want because it was eye candy, lugging the family around and possibly going to the food mall because everyone is tired and hungry, the stress and the costs, our products purchased for a few extra dollars more, online with us, works out to be much more affordable. As a member it is also much better to purchase from yourself and your own Cooperative Syndicate as you are a member that shares in it's profit margins, which really is a discount in anyone's book.

STOP purchasing someone else's products and services, giving away your money to outside competitors that could have helped you, other pledge members, your own co-op, the syndicator company and the manufacturer/supplier within the co-op network you belong too.

As a working cooperative, members increase the revenue of their syndicate(s) by the business activity they are actively involved in, providing a share of the commission to their syndicate and upfront commissions for themselves which can cover any initial outlay. The more you do, the more you get out of it but in doing so the syndicate get's a (%) percentage share of each sale of the products and services you actively promote, list, sell, buy, barter, refer, trade and exchange that you are a beneficiary of when assets accumulate and increase in value. At some time in the future (if and when that happens) the shareholders decide on winding the syndicate down, the assets are sold, shares are disbursed and the syndicate is closed for business entirely. It will be the board of directors, made up of directors from the co-op companies within our network that will decide on the shares disbursement each member get's, as it will be based on productivity and effort each member proactively participated in. If you are a businesses that requires more sales, then a cooperative is the answer and for an individual, the opportunities of employment and contracting will be endless.

Each syndicate will have access to the Syndicator Company and it's Group of Companies products and services within the co-op network during the contractual term of engagement. These contracts can be terminated if there are any breaches. If the before occurs, the Syndicator Company will step into the terminated position and resume the responsibility of it's membership.

Each syndicate will be managed by the Guardian Syndicator under the Syndicator Company for the duration of the syndicate(s) life, even when it forms it's own entity. The Guardian Syndicator or Syndicator Company can never be over-thrown or voted out of office. The Guardian Syndicator of the Syndicator Company is 100% Shareholder and founding initiator of Global Advertising Internet Network Limited and each syndicate will be a subsidiary group in a group of cooperative's that the Guardian Syndicator and Syndicator Company will be a shareholder. This by no means, give's any pledge member the idea that they are shareholders of the Syndicator Company, Global Advertising Internet Network Limited as Gavin Marsich is the 100% shareholder of the Syndicator Company with a private discretionary trust will and testament that has succession trustees and beneficiaries. The Syndicate has only been initiated by the Syndicator Gavin Marsich under the umbrella of an advertising, sales and marketing company that was established 26th January 2012. Other subsidiary business concepts that are owned my Gavin Marsich are also part of the cooperative and form the foundation blocks of Global Advertising Internet Network Limited. The syndicates bank account initially is a subsidiary bank account of the company and the concept is owned by the Syndicator Gavin Marsich.

The syndicate is not designed for profit necessarily, but for creating better employment opportunities, trade & commerce, cooperative industry, improving environment, agriculture, fisheries, natural energy, education, transportation, waste management, housing homeless, produce markets, developing community projects and generally bringing people together more under a divine governance, out of the private into the public working in cooperative communities around Aotearoa and eventually around the world to end poverty and oppression forever.

If after a minimum of (5) five years the members quorum of 80% votes to wind the Working Cooperative Syndicate down, then all assets will be sold and each pledge member will receive their share of the remaining equitable value after costs as a shareholders dividend. Then the cooperative syndicate share's portfolio will resume under new syndicate pledge member's. Each share will be offered for sale to other syndicate's to take over your share's or offered to the open market for public offering. This process may take some time as it is always a drawn-out lengthy process.

It is the interest of the Guardian Syndicator and the Syndicator Company to reach a goal of 144 Syndicates with 1,000 pledges each, a divine number we would like to reach, consisting of business owners, each with a pledge, a profile and a business of their own that intends to establish their own syndicate 1000 groups to set the world stage for a GLOBAL RESET of the 144,000 Saints.

Cooperative Capital Aotearoa set the bench mark for the concept of Syndicate 1,000 Group. It lets a community of people pledge small amounts of money, vote on how they want to use it to generate returns with a focus on improving their neighborhood, community or city.

The only commitment to secure your portfolio segment(s) initially is the weekly $10 contribution pledge to start from the launch date and first depositor of any new syndicate portfolio, who is normally the Syndicator Gavin Marsich. Each syndicate portfolio consists of 1,000 pledges of members of each syndicate. When each syndicate portfolio reaches it's desired target, a New Syndicate Portfolio is established. If however, Gavin Marsich can find suitable candidates to establish syndicate portfolio's with 1,000 pledge member's in each, the cooperative industry will develop much sooner, catering for the growing interest in the Working Cooperative model. These manager's will manage their respective syndicate portfolio's and share 50/50 of the 10% management tithe and the increase to 20% when the threshold of $5,000,000 is reached that the Company receives. Everyone is a winner and nobody is left behind when each member of the cooperative receives a share of the margins. No matter what date you start to the build-up to the 1,000 pledges, your $10NZD contribution pledge will always be back-dated to the launch date of any New Syndicate, so that it keeps everyone on an equal footing and each individual member has equal opportunity to excel in a working cooperative. The $1,000NZD Capital Pledge will be required when we reach 1,000 pledges or before, secured at a meeting of people who have made their $10NZD a week contribution term pledge and locked in 4 friends per segment they own. We are clear about our motives to establish a joint venture. Therefore we expect the pledge member's commitment from the outset with an up-front $1,000NZD immediately or as soon as possible before they have any say.

PLEASE NOTE:

It is clear we have altered the original concept slightly to encompass 1,000 pledge member's contributing a 1% or $10NZD weekly ongoing contribution pledge on each portfolio segment block to create an income base for each shares portfolio syndicate trust for future debt servicing account for borrowed equitable funds and an upfront $1,000NZD Capital Pledge to procure assets and profitable investments for a retirement fund and added the affiliate referral program of securing 4 or more pledge member's within the first month of joining to share the workload equally among the member's so there is no animosity later.

An investment committee will review and rate all opportunities, and the larger group of investors will vote on the top (5) five. The winning choices will go into a due diligence stage, in which Company Syndicator will determine if the investment can produce at least a 6% annual rate of return.